Feel free to download and use the codes. Please cite the source if you use them in public events or for publication.

Videos

Video tutorials are available at the links below:

- Tutorial 1: How to create a simple SFC model in R: First Part

- Tutorial 2: How to create a simple SFC model in R: Second Part

Request the passwords to access the videos by contacting marco.veronese.passarella@gmail.com. The related codes and additional codes can be downloaded from my GitHub repository. NEW

See also the seminar by Gennaro Zezza on Applied Stock-Flow Consistent Modelling (YouTube)

R codes for selected SFC and AB toy models (see also my GitHub repository).

- Six lectures on SFC models, November-December 2023. NEW

- SIM model. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 3, figures 3.2 and 3.3. See also: Matlab version; Python version; EViews version (from Gennaro Zezza‘s website). If you would like to receive a Simulink version, just contact me.

- SIM model 2. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 3, figure 3.1.

- SIM micro model. This code replicates model SIM but using individual consumption functions.

- SIM SFCR model. This code replicates model SIM by using the SFCR package. It is an amended version of the original code developed by Joao Macalos.

- PC model. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 4, figures 4.3 and 4.4.

- EMP model (or PC BIMETS model). This code replicates and estimates model PC by using Eurostat data for Italy and the Bimets package. NEW

- PCEX2 model. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 4, figures 4.9 and 4.10.

- OPEN model. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 6, figures 6.8 to 6.11.

- OPENFLEX model. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 12.

- OPENSIME model. This code replicates the OPENSIME model presented and used in E. Carnevali, “A New, Simple SFC Open Economy Framework”, Review of Political Economy, 2021, DOI: https://doi.org/10.1080/09538259.2021.1899518

- BMW model. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 7, figures 7.1 to 7.4.

- DAFNIK model. This code was developed by Yanis Dafermos and Maria Nikolaidi. It allows creating a SFC model calibrated using data for the US economy

- AB SIMEX model. This code was developed by Alessandro Caiani. It allows creating a simple Agent-Based SFC model, building upon model SIM.

Other useful codes:

- HIA model. This code replicates results in the book Economics with Heterogeneous Interacting Agents, by Alessandro Caiani, Alberto Russo, Antonio Palestrini and Mauro Gallegati, chapter 2.2, figure 2.4.

- VAR model. This code allows creating a 3-variable VAR model as a reduced-form DSGE model. US data are used. EViews version, R version, data (xls), data (csv).

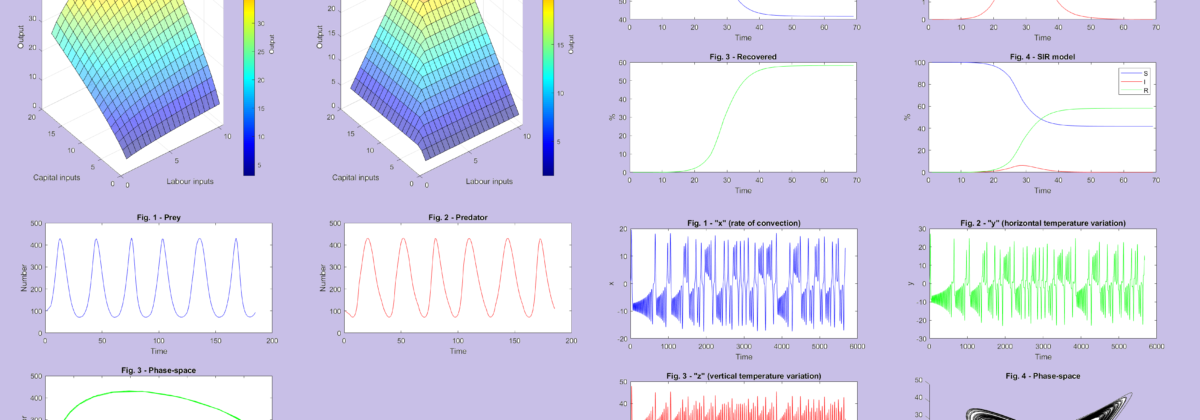

- Lotka-Volterra model. This code creates a prey-predator model. EViews version, R version.

- A simple input-output model, also calculating reproduction prices.

- LUBS1620 models. These R codes replicate the experiments conducted in my LUBS1620 lectures. PKE model, ME model, MAE model, PKE-SFC model.

- Solow model. This code replicates the dynamics of a Solow-like growth model.

- SIR model. This code replicates a simple Susceptible-Infected-Recovered model of virus spread, assuming a fixed population with only three compartments (susceptible, infected and removed).

- SIM interactive model with Shiny. This code replicates results in the book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, by Wynne Godley and Marc Lavoie, chapter 3.

Models from my publications

Web resources for SFC modellers and other useful links:

- Quick guide to R commands: Base R cheat sheet

- Repository of SFC models: Zezza website

- SFC modelling step by step: Dafermos website

- R and Python SFC models: Jo Michell website

- SFC packages and other material: Godin website

- Everything on Agent-Based Computational Economics: Tesfatsion website

- JMAB simulation toolkit: Caiani website

- SFCR package: Macalos website

- Model simulations: Kohler website

- Interactive macro: Bramucci website

- Godley package: Gamrot website

- DIY Macroeconomic Model Simulation: Kohler and Prante website