ARTICLES IN PEER-REVIEWED ECONOMICS JOURNALS

2025: Keynes, Graziani, and non-bank financial intermediaries: A stock-flow consistent analysis (with R. Canelli, G. Fontana and R. Realfonzo), Review of Political Economy, accepted for publication on 2 December 2025. [Go to the R code: —]

2025: The Impact of CBDC-Based Disintermediation on the Banking Sector and the Economy: An SFC Approach (with A. Bhattacharjee and G. Carlomagno), Review of Political Economy, accepted for publication on 14 November 2025. [Go to the R code: CBDC model; CBDC charts]

2025: Destabilizing a Stable Economy: Minsky Meets Graziani’s Monetary Circuit, International Journal of Political Economy, published online on 1 September 2025. [Go to the R code: GRAMI model]

2025: Macroeconomic Models for Assessing the Transition towards a Circular Economy: A Systematic Review (with J.B.R.T. Fevereiro, A. Genovese, B. Purvis and O. Valles Codina), Ecological Economics, 236, 108669.

2025: China’s development strategy: an open-economy perspective (with E. Carnevali and Dongna Zhang), Structural Change and Economic Dynamics, 74(3), pp. 405-415.

2024: Energy crisis, economic growth and public finance in Italy (with R. Canelli, G. Fontana and R. Realfonzo), Energy Economics, 132, 107430. [Go to the R codes: Italy-SFC-Model]

2024: Tributo di un allievo mancato, Rivista Economica del Mezzogiorno, 3(1), pp. 521-523.

2024: It is not la vie en rose. New insights from Graziani’s theory of the monetary circuit, European Journal of Economics and Economic Policies: Intervention, 21(3), pp. 461-485. [Go to the R code: TMC-SFC-Model-R; go to the (tentative) Python code: TMC-SFC-Model-Python]

2023: Introduction to the special issue on stock-flow consistent models (with R. Canelli and M. Deleidi), Bulletin of Political Economy, 17(1), pp. 1-4.

2023: Economy-Finance-Environment-Society Interconnections in a Stock-Flow Consistent Dynamic Model (with E. Carnevali, M. Deleidi and R. Pariboni), Review of Political Economy, 36(2), pp. 844-878. [Appendix A, Appendix B, go to the EViews code: model; dowload the dataset: data]

2022: Is the Italian government debt sustainable? Scenarios after the Covid-19 shock (with R. Canelli, G. Fontana and R. Realfonzo), Cambridge Journal of Economics, 46(3), pp. 581-587. [Go to the R code: Italy-SFC-Model]

2022: Inequality and exchange rate movements in an open-economy macroeconomic model (with E. Carnevali and F. Ruggeri), Review of Political Economy, 36(2), pp. 722-760. [Access the EViews code and the dataset from my GitHub profile: ROPE 2022]

2021: A comprehensive comparison of fiscal and monetary policies: a comparative dynamics approach (with M. Sawyer), Structural Change and Economic Dynamics, 59(4), pp. 384-404. [Go to the R code: STRECO 2021]

2021: Are EU Policies Effective to Tackle the Covid-19 Crisis? The Case of Italy (with R. Canelli, G. Fontana and R. Realfonzo), Review of Political Economy, 33(3), pp. 432-461. [Download the R code: Italy-SFC-Model]

2020: Cross-Border Financial Flows and Global Warming in a Two-Area Ecological SFC Model (with E. Carnevali, M. Deleidi and R. Pariboni), Socio-Economic Planning Sciences, 75, 100819. [Download the EViews code: openeco model, data]

2020: Unconventional Monetary Policies from Conventional Theories: Modern Lessons for Central Bankers (with G. Fontana), Journal of Policy Modeling, 42(3), pp. 503-519.

2020: Monetary Economics after the Great Financial Crisis: What Has Happened to the Endogenous Money Theory? (with G. Fontana and R. Realfonzo), European Journal of Economics and Economic Policies: Intervention, 17(3), pp. 339-355.

2020: Assessing the Marshall-Lerner Condition within a Stock-Flow Consistent Model (with E. Carnevali and G. Fontana), Cambridge Journal of Economics, 44(4), pp. 891-918. [Download the EViews code: openflex model, openfix model]

2020: Productivity growth, Smith effects and Ricardo effects in Euro Area’s manufacturing industries (with E. Carnevali, S. Lucarelli and A. Godin), Metroeconomica, 71(1), pp. 129-155.

2019: From abstract to concrete: some tips to develop an empirical SFC model, European Journal of Economics and Economic Policies: Intervention, 16(1), pp. 55-93. [Download files: EViews model, dataset, household TFM (R), household BS (R), appendices]

2017: The monetary circuit in the age of financialisation: a stock-flow consistent model with a twofold banking sector (with M. Sawyer), Metroeconomica, 68(2), pp. 321-53. [Download the EViews file: DER Model]

2017: The Extent and Variegation of Financialisation in Europe: a Preliminary Analysis (with A. Brown and D. Spencer), Revista de Economia Mundial (World Economy Journal), 46(3), pp. 49-70.

2016: The theoretical legacy of Augusto Graziani (with R. Bellofiore), Review of Keynesian Economics, 4(3), pp. 243-49.

2015: Capital’s humpback bridge. Financialisation and the rate of turnover in Marx’s economic theory (with H. Baron), Cambridge Journal of Economics, 39(5), pp. 1415-1441.

2014: Financialization and the monetary circuit: a macro-accounting approach, Review of Political Economy, 26(1), pp. 128-148.

2012: A simplified stock-flow consistent dynamic model of the systemic financial fragility in the ‘New Capitalism’, Journal of Economic Behavior & Organization, 83(3), pp. 570-582.

2011: From the village fair to Wall Street. The Italian reception of Minsky’s economic thought, Rassegna Economica, 74(1), pp. 111-132.

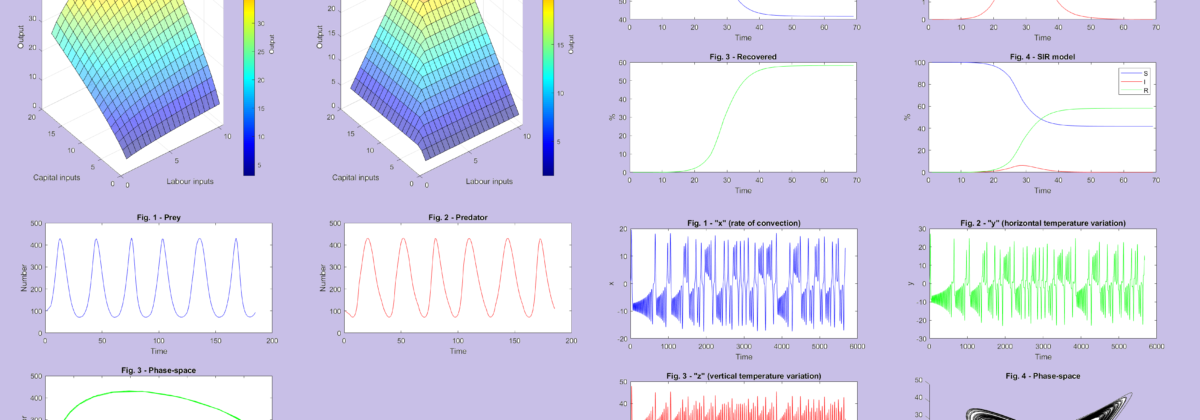

2010: The paradox of tranquility revisited. A Lotka-Volterra model of the financial instability, Italian Economic Journal (Rivista Italiana degli Economisti), 15(1), pp. 69-104.

2009: Marx in the matrix. L’algebra del “lavoro vivo”, History of Economic Thought and Policy (Storia del Pensiero Economico), 6(2), pp. 31-48.

ARTICLES IN JOURNALS OF PHILOSOPHY, POLICY AND HISTORY

2025: Breaking with the Classicals? A Reassessment of Marx’s Relationship with Classical Political Economy, Dialettica e Filosofia, special issue: “Marx after Heinrich: Debating the Science of Value“, pp. 87-90.

2022: Sequence and class divide: a reply to the critics of the theory of the monetary circuit, English version, Augusto Graziani Blog, September 2022.

2022: Sequenza e classi: una risposta ai critici del circuito monetario, Italian version, Augusto Graziani Blog, September 2022.

2022: Inflazione: la lotta di classe è l’elefante nella stanza, Fondazione Feltrinelli, April 2022.

2022: Catastrophe or Revolution (with E. Brancaccio), Rethinking Marxism, 34(3), pp. 317-337.

2021: L’efficacia del Next Generation EU per la ripresa dell’economia italiana (with R. Canelli, G. Fontana and R. Realfonzo), Economia e Politica: Rivista On-line di Critica della Politica Economica, March 2021.

2020: Le determinanti della produttività del lavoro nell’Area Euro (with S. Lucarelli), Economia e Politica: Rivista On-line di Critica della Politica Economica, March 2020.

2017: La situazione della classe operaia in Inghilterra due secoli dopo (with A. Genovese), Critica Marxista, 4(5): 1-6.

2014: Moneta, finanza e crisi: Marx nel circuito della moneta, Iride. Filosofia e Discussione Pubblica, 28(74), pp. 67-78.

2014: Welfare, mercato e piano: critica del paradigma liberoscambista, Ragion Pratica, 42(1), pp. 9-33.

2013: Le mille bolle del mercato finanziario (with E. Brancaccio), Economia e Politica: Rivista On-line di Critica della Politica Economica, October 2013.

2010: Concorrenza senza equilibrio. La “Scoperta Imprenditoriale” nella Teoria Economica Austriaca (with H. Baron), Storia e Politica, 2(2), pp. 416-442.

2009: La scienza triste e la farfalla di Lorenz. Perché gli economisti non hanno previsto la crisi economica, Economia e Politica: Rivista On-line di Critica della Politica Economica, July 2009.

CHAPTERS IN BOOKS

2026: Modelling the Circular Economy with a Simple IO-SFC Model, in S. D’Alessandro, T. Distefano and M. Guilherme (eds.), Handbook in Ecological Economics, Open Book Publishers, forthcoming.

2024: Decolonizing CE: some reflections on theory and praxis from the JUST2CE experience (with E. Girei, A. Jimenez, T. Doezema, B. Purvis, M. Ripa, J. Sousa, M. Pansera, and A. Genovese), in R. Passaro, P. Ghisellini, M. Pansera, S. Barca, and M.C. Friant (eds.), Circular Economy for Social Transformation: Multiple Paths to Achieve Circularity, LEDIpublishing, JUST2CE ebook, pp.137-150.

2024: Using input-output stock-flow consistent models to simulate and assess ‘circular economy’ strategies (with M. Bimpizas-Pinis, A. Genovese, A. Kaltenbrunner, E. Kesidou, B. Purvis, J.B. Ramos Torres Fevereiro, and O. Valles Codina), in R. Passaro, P. Ghisellini, M. Pansera, S. Barca, and M.C. Friant (eds.), Circular Economy for Social Transformation: Multiple Paths to Achieve Circularity, LEDIpublishing, JUST2CE ebook, pp. 244-257.

2023: Central bank digital currencies: Exploring the transformative implications on credit mechanisms and the banking system (with G. Carlomagno), Reference Module in Social Sciences, Elsevier.

2023: Monetary circuit – Italian School, in L.P. Rochon and S. Rossi, (eds.), Elgar Encyclopedia of Post-Keynesian Economics, Northampton: Edward Elgar, p. 280.

2023: Capitalism, in L.P. Rochon and S. Rossi, (eds.), Elgar Encyclopedia of Post-Keynesian Economics, Northampton: Edward Elgar, p. 47.

2020: How are goods and services valued in economics?, in K. Deane and E. Van Waeyenberge (eds.), Recharting the History of Economic Thought, Basingstoke & New York: Palgrave Macmillan, chapter 9.

2019: SFC dynamic models: features, limitations and developments (with E. Carnevali, M. Deleidi and R. Pariboni), in P. Arestis and M. Sawyer (eds.), Frontiers of Heterodox Economics, Series: International Papers in Political Economy, Basingstoke & New York: Palgrave Macmillan, pp. 223-276. [go to the EViews code]

2019: A Marx “crises” Model. The reproduction schemes revisited, in A. Moneta, T. Gabellini and S. Gasperin (eds.), Economic Crisis and Economic Thought: Alternative Theoretical Perspectives on the Economic Crisis, London: Routledge, pp. 135-165. [go to the EViews-code; go to the R-code]

2018: The role of commercial banks and financial intermediaries in the New Consensus Macroeconomics (NCM): a preliminary and critical appraisal of old and new models (with G. Fontana), in P. Arestis (ed.), Alternative Approaches in Macroeconomics: Essays in Honour of John McCombie, Basingstoke & New York: Palgrave Macmillan, pp. 77-103.

2017: Monetary Theories of Production, in T. Jo, L. Chester and C. D’Ippoliti (eds.), Handbook of Heterodox Economics, London: Routledge, pp. 77-103. (download the first draft)

2015: Financial integration, in L.P. Rochon and S. Rossi (eds.), The Encyclopedia of Central Banking, Northampton: Edward Elgar, pp. 195-197.

2015: Minsky, in L.P. Rochon and S. Rossi (eds.), The Encyclopedia of Central Banking, Northampton: Edward Elgar, pp. 315-318.

2012: New Research Perspectives in the Monetary Theory of Production: an Introduction (with S. Lucarelli), in S. Lucarelli and M. Passarella (eds.), New Research Perspectives in the Monetary Theory of Production, Bergamo: Bergamo University Press of Sestante Edizioni, pp. 13-21.

2012: A Re-Formulation of Minsky’s ‘Two-Price Model’, in S. Lucarelli and M. Passarella (eds.), New Research Perspectives in the Monetary Theory of Production, Bergamo: Bergamo University Press of Sestante Edizioni, pp. 109-126.

2010: Minsky in the “new” capitalism. The new clothes of the Financial Instability Hypothesis (with R. Bellofiore and J. Halevi), in D. Papadimitriou and L.R. Wray (eds.), The Elgar Companion to Hyman Minsky, Northampton: Edward Elgar, pp. 84-99.

2009: Finance and the Realization Problem in Rosa Luxemburg: a ‘Circuitist’ Reappraisal (with R. Bellofiore), in J.F. Ponsot and S. Rossi (eds.), The Political Economy of Monetary Circuits: Tradition and Change in Post-Keynesian Economics, Basingstoke & New York: Palgrave Macmillan, pp. 98-115.

WORKING PAPERS & REPORTS

2023: Technical change and the monetary circuit: an input-output stock-flow consistent dynamic model, Department of Economics and Statistics – University of Siena, WP No. 903. [Go to the R code: Siena_model-R]

2022: It is not la vie en rose. New insights from Graziani’s theory of monetary circuit, PKES WP No. 2209. [Go to the R code: TMC-SFC Model; go to the Python code: TMC-SFC-Model-Python]

2019: Cross-Border Financial Effects of Global Warming in a Two-Area Ecological SFC Model (with E. Carnevali, M. Deleidi and R. Pariboni), UMass Amherst Economics, WP No. 2019-02.

2019: Supermultiplier, innovation and the ecosystem: A stock-flow dynamic model (with M. Deleidi and R. Pariboni), Institute for Innovation and Public Purpose, UCL, WP No. 2019-01.

2016: A Marx ‘crises’ model. The reproduction schemes revisited, PKSG Working Paper Series, WP PKWP1610.

2015: Aggregate demand, money and finance in the New Consensus macroeconomics: a critical appraisal (with G. Fontana), FESSUD Working Paper Series, No. 198.

2015: The nature and variegation of financialisation: a cross-country comparison (with A. Brown and D. Spencer), FESSUD Working Paper Series, No. 127.

2015: The Swedish Financial System (with A. Stenfors, E. Clark, I. Farahani, and A.L. Hansen), FESSUD Studies in Financial Systems, No. 13.

2014: Contro il liberoscambismo, MPRA Paper No. 60350.

2014: The Economics of Infrastructure (with A. Brown and M. Robertson), in A. Brown and M. Robertson (eds.), Economic evaluation of systems of infrastructure provision: concepts, approaches, methods, i-BUILD/Leeds Report, pp. 12-17.

2014: The Process of Financial Integration of EU Economies, FESSUD Working Paper Series, No 30.

2014: Financialisation in the Circuit (with M. Sawyer), FESSUD Working Paper Series, No. 18. 2013: Financial integration in the European Union: an Analysis of the ECB’s role, FESSUD Working Paper Series, No. 4.

2013: Capital’s pons asinorum: the rate of turnover in Karl Marx’s analysis of capitalist valorisation (with H. Baron), STOREPapers, WP No. 16 (also: MPRA Paper No. 48306).

2012: Systemic financial fragility and the new monetary circuit: a stock-flow consistent Minskian approach, University of Bergamo, Quaderni del Dipartimento di Scienze Economiche “Hyman P. Minsky”, No. 2 (2012).

2011: The two-price model revisited. A Minskian-Kaleckian reading of the process of financialization, MPRA Paper No. 32033.

2011: A simplified stock-flow consistent dynamic model of the systemic financial fragility in the ‘New Capitalism’, MPRA Paper No. 28499.

2011: Systemic financial fragility and the monetary circuit: a stock-flow consistent approach, MPRA Paper No. 28498.

2011: Per una storia analitica dell’economia politica. Alcune considerazioni sulle prospettive della Storia del Pensiero Economico, MPRA Paper No. 28674.

2010: Concorrenza senza equilibrio. La “scoperta imprenditoriale” nella Teoria Economica Austriaca (with H. Baron), MPRA Paper No. 28505.

2010: Rethinking economics after the financial crisis. A Minskian-Kaleckian stock-flow consistent accounting framework, King’s College London, JMCE, Working Paper No. 2010/02.

BOOKS

Tempesta perfetta, Noi restiamo (eds.), Turin: Odradek, 2016.

L’austerità è di destra. E sta distruggendo l’Europa (with E. Brancaccio), Milan: Il Saggiatore, 2012.

John M. Keynes: Vi spiego la Borsa. Dalla Teoria generale dell’occupazione, dell’interesse e della moneta, edited by Giorgio Gattei and Marco Passarella, Ogni uomo è tutti gli uomini editore, 2012.

Il gatto e lo stregone, in C. Orsi (ed.), Il capitalismo invecchia? Sei domande agli economisti, Rome: Manifestolibri, 2010.

PhD DISSERTATION

2008: Finance Matters! Genesi e sviluppo della Teoria del Circuito Monetario in Italia, PhD Dissertation, University of Florence, Academic Year 2007-2008.

OTHER PAPERS

Per sfidare l’economia dominante, serve un approccio scientifico, Kritica Economica, 12 February 2024.

Lo Stato gendarme del Capitale: il lascito teorico di Margaret Thatcher, MicroMega, 7 April 2023.

L’agenda Monti ai raggi x, MicroMega, n. 2, 2013. [Download the PDF]

Salario unico contro l’austerità, Il Fatto Quotidiano, 26 June 2012.

2012: Review of “Inequality and instability” by James K. Galbraith, Economic Issues, 17(2): 114:115. (Extended version)

2012: Finanse i problem realizacji u Róży Luksemburg: interpretacja ‘cyrkulatywistyczna’ (with R. Bellofiore), Praktyka Teoretyczna, 6: 275-298.

2011: Speech at “Il profeta della crisi. Tributo ad Hyman Minsky“, Quaderni della Fondazione Zaninoni, 19: 42-49.

(Review to) André Orléan, Dall’euforia al panico. Pensare la crisi finanziaria e altri saggi, Scienza e Pace: Rivista del C.i.s.p., University of Pisa, 2009.